2019 IN REVIEW

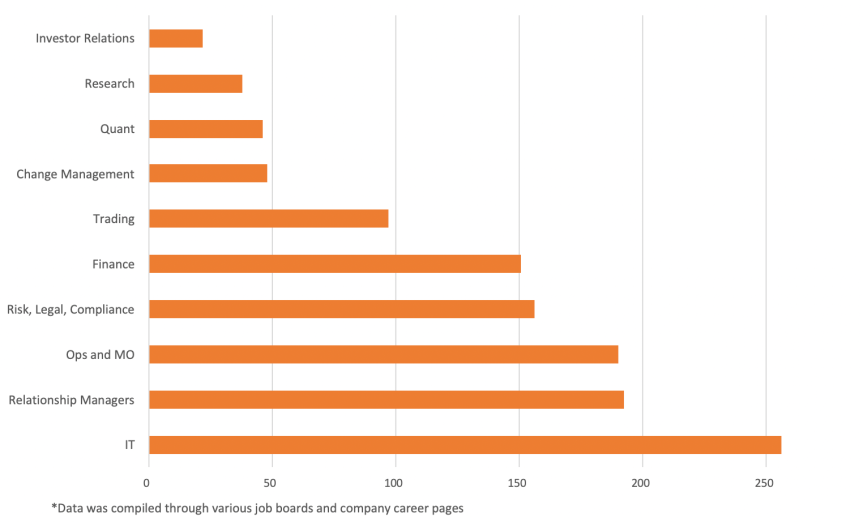

The job market in this segment didn’t perform as expected in 2019. We saw a slower than usual Q2 due to hiring managers being more cautious and conservative in their human resource planning. This is partially a result of the ongoing trade war and slowing economy. However, banking hires ramped up in Q3, adding 35% more vacancies than the first half of the year.

Operations and middle office hires are making a comeback with a focus on fund services, portfolio valuations and client services. This trinity is due to the expanding business of service providers competing to provide higher quality service to investment banks, hedge funds and private equity firms.

2020 OUTLOOK AND TRENDS

In 2020, we expect an increased demand within the private equity and hedge fund space for fund accountants and client services positions. This is not surprising as service providers have been enjoying steady and consistent growth in 2019.

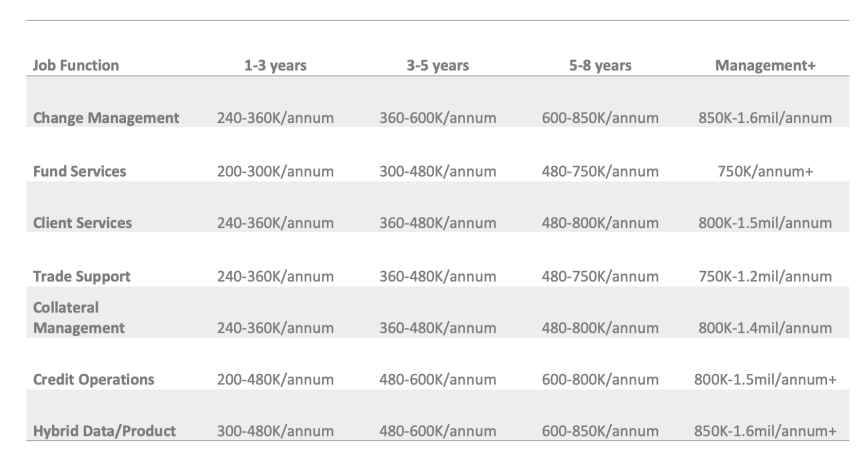

As companies ramp up their digital capabilities, we will see that effect resonate within operations and the middle office. Companies are making a push to make more data-driven decisions and at the end of 2019, we saw a growing demand for operations candidates with coding skills in Python, VBA and SQL. We expect this trend to continue in 2020 as more companies integrate these hybrid roles into their operations function.

What does this mean for hiring managers and candidates within the Middle Office, Operations and Change Management function?

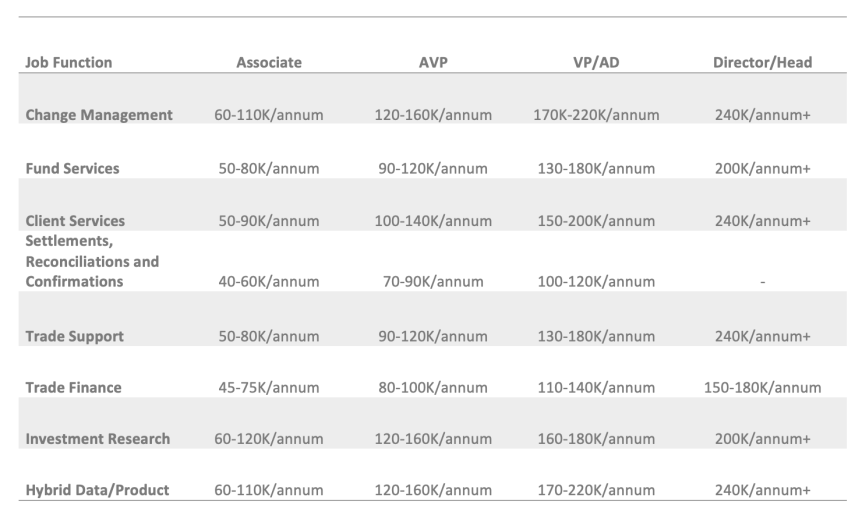

In our 2020 trends and salary report for the Middle Office, Operations and Change Management function, we offer some guidance:

- To hiring managers, on securing the best talent in today’s market and a salary guide to help you pay them right.

- To candidates, on top skills to help you stay relevant and in-demand in today’s banking and financial services landscape.